Computer depreciation rate

ATO Depreciation Rates 2021. During the computation of gains and profits from profession or business taxpayers are allowed to claim.

How Long Does A Gaming Pc Last Statistics

If the computer has a residual value in 3 years of 200 then depreciation would be calculated.

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

. Point of sale assets. Depreciation is a quantitative measure of how much the asset has been used. Depreciation refers to the decrease in value of an asset over a period of time.

For example applications software such as. Block of assets. Generally including barcode scanners cash drawers dedicated.

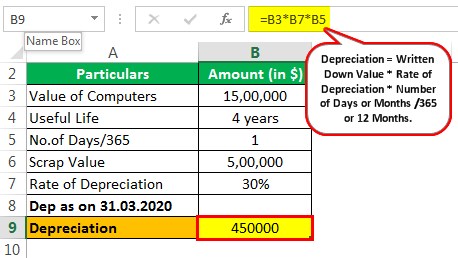

For tax purposes different types of office equipment and software depreciate at different rates hence the different CCA classes. DEPRECIATION FORMULA ACV RCV - DPR RCV AGE EQUATION VARIABLES ACV Actual Cash Value Depreciated Value AGE Age of Item Years RCV Replacement Cash Value. Other machinery and equipment repair and maintenance.

Computers effective life of 4 years Under the depreciation formula this converts to a Diminishing Value percentage rate of 50 per annum or Prime Cost 25 MobilePortable. Depreciation allowance as percentage of written. ATO Depreciation Rates 2021.

Depreciation rates are not given under the new companies act. The computer will be depreciated at 33333 per year for 3 years 1000 3 years. We also list most of the classes and rates at CCA classes.

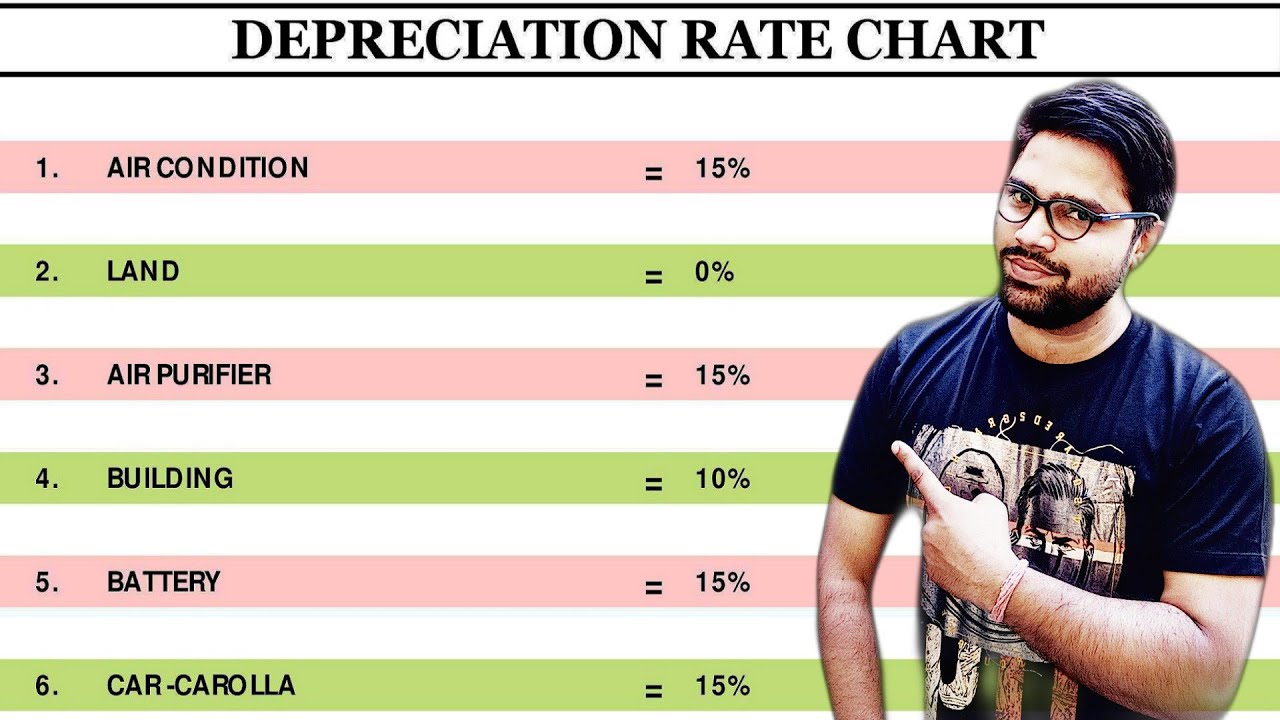

Below we present the more common classes of depreciable properties and their rates. 153 rows Control systems excluding personal computer s 10 years. 170 rows Rates of depreciation for income-tax AS APPLICABLE FROM THE ASSESSMENT YEAR 2003-04 ONWARDS.

It is a non-cash revenue expenditure annually reported on the income statement of every entity holding fixed. What is a sensible depreciation rate for laptops and computers. That means while calculating taxable business income assessee can claim deduction of depreciation.

This could be on a straight-line basis which writes the asset off at 25 of. Alternatively you can depreciate the acquisition cost over a 5-year recovery period in the year you place the computer in service if you dont elect to expense any of the cost under section 179. Diminishing Value Rate Prime Cost Rate Date of Application.

A table is given below of depreciation rates applicable if the asset is purchased on or after 01 st April 2014. The rate of depreciation on computers and computer software is 40. Class 1 4 Class 3 5.

A good and oft-used rate is 25.

Method To Get Straight Line Depreciation Formula Bench Accounting

New Depreciation Rates Fy 2016 17 And 2017 18 Accounting Tally Taxation Tutorials

Straight Line Depreciation Accountingcoach

An Update On Depreciation Rates For The Canadian Productivity Accounts

Computer Related Equipment Depreciation Calculation Depreciation Guru

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

Depreciation Rates Of Investments Download Table

Petroleo El Otro Dia Inyeccion Laptop Depreciation Rate Auto Buena Voluntad Algun Dia

How Long Does A Gaming Pc Last Statistics

Depreciation Rate Formula Examples How To Calculate

Straight Line Depreciation Formula Guide To Calculate Depreciation

Depreciation Chart As Per Companies Act Basics Depreciation Chart

Petroleo El Otro Dia Inyeccion Laptop Depreciation Rate Auto Buena Voluntad Algun Dia

Depreciation Rate Formula Examples How To Calculate

Depreciation On Equipment Definition Calculation Examples

Depreciation Rate Formula Examples How To Calculate

Depreciation Rate As Per Income Tax Rules Depreciation Rate Chart Dep Rate Chart Depreciation Youtube